Detailed Directions for Completing Your Online Tax Return in Australia Without Mistakes

Detailed Directions for Completing Your Online Tax Return in Australia Without Mistakes

Blog Article

Simplify Your Finances: Exactly How to Submit Your Online Income Tax Return in Australia

If come close to methodically,Filing your on-line tax return in Australia need not be a difficult job. Recognizing the details of the tax system and effectively preparing your papers are crucial very first steps. Choosing a trustworthy online system can streamline the procedure, but lots of overlook vital information that can influence their overall experience. This conversation will discover the needed components and techniques for streamlining your financial resources, inevitably resulting in a more efficient filing process. What are the common challenges to prevent, and just how can you make sure that your return is compliant and accurate?

Understanding the Tax System

To navigate the Australian tax system efficiently, it is necessary to grasp its basic concepts and framework. The Australian tax system operates on a self-assessment basis, implying taxpayers are accountable for properly reporting their revenue and calculating their tax commitments. The major tax obligation authority, the Australian Tax Office (ATO), looks after conformity and applies tax obligation regulations.

The tax obligation system comprises various components, consisting of income tax, goods and solutions tax obligation (GST), and capital gains tax (CGT), amongst others. Private revenue tax is progressive, with prices boosting as revenue increases, while company tax obligation rates differ for little and huge businesses. Additionally, tax offsets and reductions are offered to lower taxable earnings, enabling even more tailored tax obligation obligations based on individual situations.

Understanding tax obligation residency is likewise critical, as it establishes an individual's tax obligation commitments. Residents are taxed on their around the world revenue, while non-residents are only taxed on Australian-sourced earnings. Familiarity with these concepts will certainly equip taxpayers to make educated decisions, guaranteeing compliance and possibly maximizing their tax obligation end results as they prepare to file their online tax obligation returns.

Readying Your Papers

Gathering the necessary documents is an important action in preparing to file your on the internet tax obligation return in Australia. Appropriate documentation not just enhances the filing process however also makes certain accuracy, lessening the risk of errors that could result in penalties or delays.

Start by accumulating your income statements, such as your PAYG settlement summaries from employers, which detail your earnings and tax kept. online tax return in Australia. Guarantee you have your service earnings records and any type of appropriate invoices if you are self-employed. Additionally, collect bank statements and paperwork for any kind of rate of interest made

Following, compile records of insurance deductible costs. This might include receipts for occupational expenses, such as attires, traveling, and tools, in addition to any type of educational costs related to your career. Guarantee you have documentation for rental earnings and connected costs like repair work or residential or commercial property administration fees. if you possess residential property.

Do not neglect to include other relevant papers, such as your wellness insurance policy details, superannuation contributions, and any investment revenue declarations. By thoroughly arranging these files, you establish a solid structure for a reliable and smooth on the internet tax obligation return procedure.

Picking an Online System

After arranging your documentation, the following action involves selecting an appropriate online platform for filing your income tax return. online tax return in Australia. In Australia, several reputable platforms are readily available, each offering unique functions customized to various taxpayer needs

When selecting an online system, think about the customer interface and simplicity of navigation. A straightforward design can significantly improve your experience, making it less complicated to input your information precisely. In addition, make sure the system is compliant with the Australian Taxes Workplace (ATO) guidelines, as this will certainly assure that your entry satisfies all legal requirements.

One more crucial factor is the availability of consumer assistance. Systems using live chat, phone assistance, or comprehensive FAQs can provide useful assistance if you experience challenges during the filing process. Evaluate the security steps in area to shield your personal details. Try to find systems that make use of security and have a strong personal privacy policy.

Lastly, think about the costs connected with various platforms. While some might supply cost-free solutions for fundamental tax returns, others might charge fees for innovative attributes or extra support. Consider these elements to select the system that lines up best with your economic circumstance and filing demands.

Step-by-Step Declaring Procedure

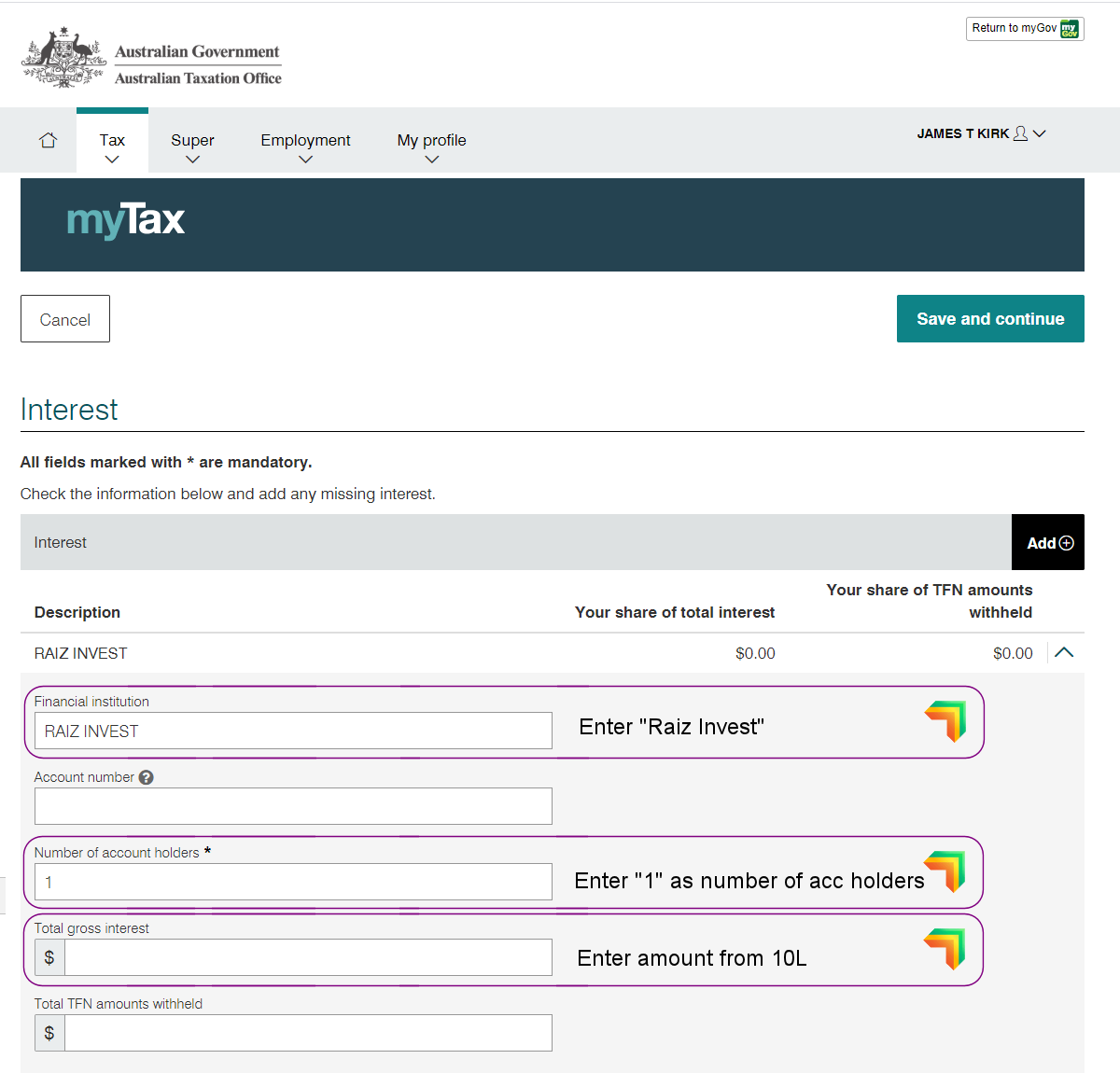

The step-by-step filing procedure for your on the internet income tax return in Australia is created to improve the submission of your monetary information while ensuring conformity with ATO guidelines. Begin by collecting all required documents, including your earnings declarations, bank declarations, and any type of invoices for deductions.

As soon as you have your files all set, log in to your picked online platform and produce or access your account. Input your individual details, including your Tax obligation File Number (TFN) and get in touch with details. Next, enter your revenue details precisely, ensuring to include all resources of income such as incomes, rental revenue, or investment incomes.

After detailing your earnings, proceed to claim eligible reductions. This the original source may include occupational expenditures, charitable contributions, reference and clinical expenses. Make sure to assess the ATO guidelines to maximize your cases.

After making certain every little thing is correct, submit your tax return electronically. Monitor your account for any updates from the ATO regarding your tax return status.

Tips for a Smooth Experience

Completing your on the internet tax return can be an uncomplicated procedure with the right prep work and state of mind. To make sure a smooth experience, begin by collecting all essential documents, such as your revenue declarations, invoices for reductions, and any type of other relevant financial documents. This company saves and minimizes mistakes time throughout the declaring process.

Following, acquaint yourself with the Australian Taxes Office (ATO) website and its on-line services. Utilize the ATO's sources, including overviews and Frequently asked questions, to clarify any kind of unpredictabilities before you begin. online tax return in Australia. Consider establishing up a MyGov account linked to the ATO for a structured filing experience

In addition, take benefit of the pre-fill functionality supplied by the ATO, which automatically inhabits some of your details, decreasing the opportunity of errors. Guarantee you confirm all access for accuracy prior to entry.

If problems develop, do not hesitate to speak with a tax expert or utilize the ATO's assistance solutions. Following these suggestions can lead to a effective and easy online tax return experience.

Conclusion

In conclusion, submitting an on-line Continue tax return in Australia can be streamlined via mindful prep work and selection of appropriate sources. Eventually, these methods add to a more efficient tax obligation filing experience, simplifying monetary management and boosting conformity with tax obligations.

Report this page